Level 3 CEO Jeffrey Storey became CenturyLink's CEO with the 2017 merger. The sideways price movement over the past three years (2019-2021) reflects the company's refocus away from local phone service to enterprise IT services and long haul connectivity by fiber cable. The subsequent downward slide was interrupted briefly with CenturyLink's 2017 $30 billion acquisition of Level 3 Communications, which included the assumption of $10.9 billion in Level 3 debt. Hopes for this merger peaked with the stock's positive price action in 2014. The 2011 price dip coincided with CenturyLink's $24 billion purchase of Qwest, which created the nation's third largest landline phone company. The freshly renamed CenturyLink saw its post-recession stock price recover to $46.87 in 2010, following peak earnings of $3.60 per share in 2009. Graph below shows the stock's price (black line) peak just before the Great Recession began in 2007 as Lumen (previously CenturyTel) anticipated transitioning from a rural phone carrier to what became the fourth largest US phone carrier by market value through its 2009 purchase of Embarq. In the Q2 2021 earnings call, CEO Jeffrey Storey said the agreement will "continue to serve the needs of our Enterprise customers based outside the region."įrom Lumen's Website Interpreting Lumen's Stock Price Lumen executed a service agreement with Stonepeak for the current management team to provide operational leadership. In July 2021, LUMN announced the sale of its Latin American business to Stonepeak Partners for $2.7 billion, implying ~9x 2020 adjusted EBITDA. The map below shows the 17 states where Lumen retains the assets and the 20 states where Apollo acquired ILECs.Īpollo assumes $1.4 billion of debt incurred with Lumen's 2009 acquisition of Embarq. In August 2021, LUMN announced the sale of its incumbent local exchange carrier telephone operations in 20 states to Apollo Global Management ( APO) for $7.5 billion, implying ~5.5x 2020 adjusted EBITDA.

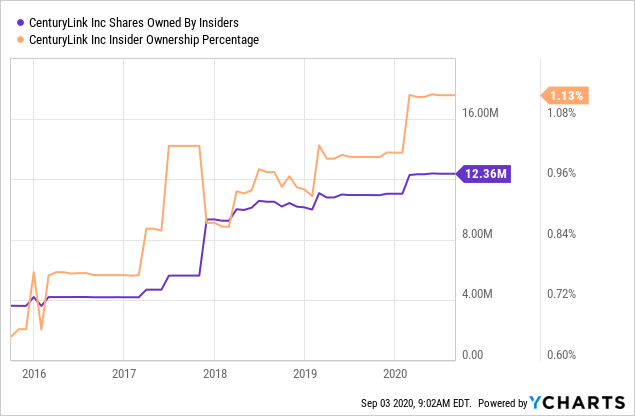

Its 2017 purchase of Level 3 Communications solidified Lumen as a communications provider for the Enterprise segment.

Lumen is an asset play for Fiber and Enterprise. Lumen offers businesses connectivity solutions that interface fiber, wireless, edge, cloud, security and local campuses. Its legacy phone company (CenturyLink, formerly CenturyTel), provides local exchange carrier services in 17 states. The company owns 450,000 route miles of fiber, including 35,000 route miles of subsea fiber connecting Europe, Asia, and Latin America. ( NYSE: LUMN) is a communications company with significant global fiber cable assets, a local telephone carrier in 17 states, and a communication services provider for businesses.

0 kommentar(er)

0 kommentar(er)